Welcome To Biggest Online compliance Platform

Human Resource & Payroll

Most businesses know that they need to issue 1099s to contractors, but did you know that payment to your attorney is considered contract labor, and you send one even if the law firm is a corporation? There are times when you don't issue 1099s to contractors -- paying them with a credit card and paying with many (but not all) payment apps such as Venmo and PayPal.

Using Form W-9 is an effective compliance tool for this and many other issues you face when it comes to issuing 1099s (or not needing to issue 1099s). Besides, backup withholding is something that is not happening -- the IRS estimates that over 400,000 payments are made each year where backup withholding should be done where it is not being done. The IRS now tries to enforce backup withholding.

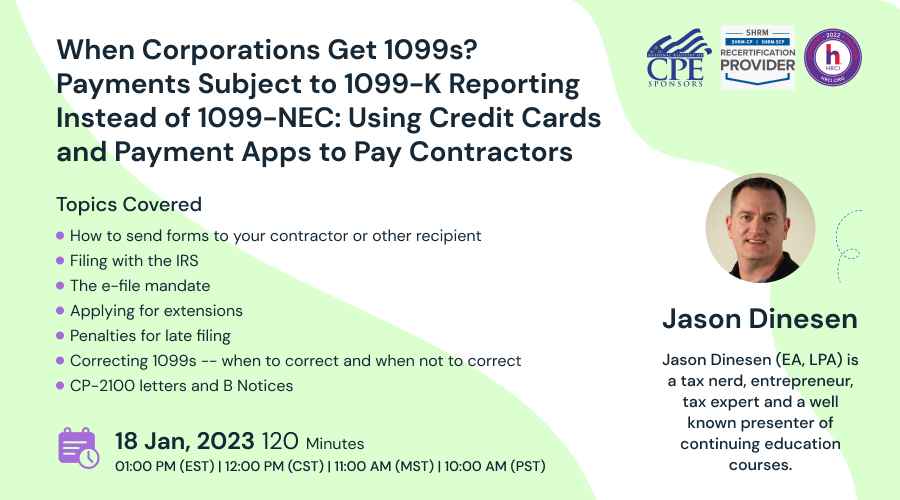

Join our taxation speaker, Mr. Jason Dinesen, on Standeagle this January to learn the most important aspects relating to issuing 1099s for situations other than regular contract labor. We will discuss how to effectively use Form W-9. We will also define what backup withholding is and how to do it.

January 31st is the deadline for filing Form 1099-NEC to contractors, and is also the deadline (in most cases) for providing Form 1099-MISC to the recipient as well. This session will cover filing issues, such as how to file, when to file, and what the penalties are. We will also cover a topic that doesn't get a lot of coverage -- or thought -- and that is, e-mailing 1099s to the recipient. Something that seems so simple actually has a lot of requirements under the regulations, and we will cover those hoops you need to jump through per the regulations. We will also cover the things you need to do after filing the 1099s: fixing errors and dealing with IRS letters.

-How to send forms to your contractor or other recipient

-Filing with the IRS

-The e-file mandate

-Applying for extensions

-Penalties for late filing

-Correcting 1099s -- when to correct and when not to correct

-CP-2100 letters and B Notices

-When do corporations get 1099s

-Form 1099-K: using credit cards and payment apps to pay contractors

-Backup withholding: when to do it and how to do it

-Effective use of Form W-9 for compliance

-In-depth on medical payments and legal payments

-Business owners

-Office managers

-Controllers

-Bookkeepers

-Managers

-CFOs

-Accountants

-EAs

Jason Dinesen is the President of Dinesen Tax & Accounting, P.C., a public accounting firm in Indianola, Iowa. Jason prepares over 200 tax returns every year and deals with a variety of situations ranging from individual taxes to business taxes. He has been presenting since 2012.

Pearleducation Webinar Certification - Pearleducation rewards you with Pearleducation Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Pearleducation Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Pearleducation doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on pearlacademy.net. Visit pearlacademy.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Pearl Education to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on Pearl Education today!

Go for the topic of your keen interest on pearlacademy.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Pearl Education offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Pearl Education offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Pearl Education has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Pearl Education brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Pearl Education webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!