Welcome To Biggest Online compliance Platform

Human Resource & Payroll

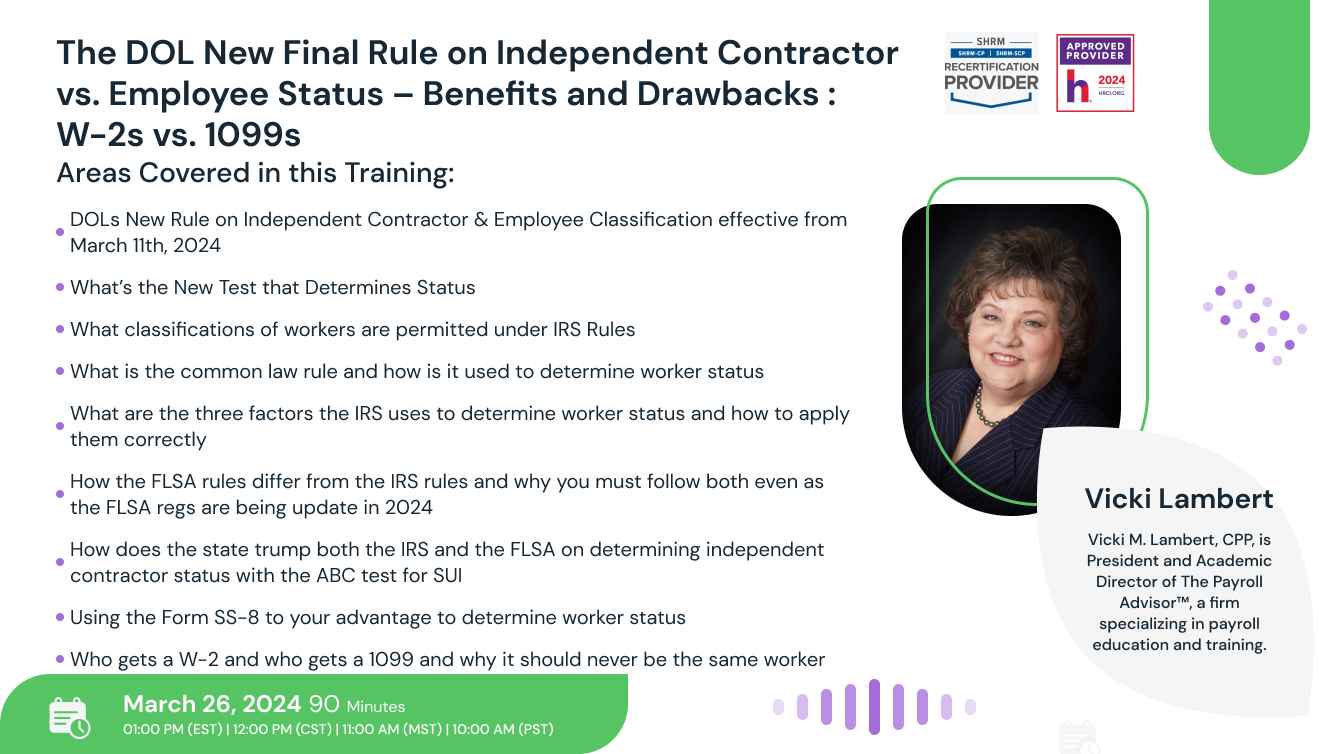

The U.S. Department of Labor’s (DOL’s) test for determining whether a worker should be classified as an independent contractor or an employee for purposes of the federal Fair Labor Standards Act (FLSA) has been revised several times over the past decade. Now, the DOL is implementing a new final rule rescinding the employer-friendly test that was developed under the Trump administration. The new, more employee-friendly rule takes effect March 11, 2024.

Misclassifying employees and independent contractors are getting costlier by the day. With federal and state agencies joining forces to combat misclassification, fines and penalties have skyrocketed. And every day the misclassification continues the penalties mount up and up until this ticking time bomb finally explodes! Find out how to defuse that ticking bomb by joining renowned payroll expert Vicki M. Lambert, CPP for this information packed webinar!

· DOLs New Rule on Independent Contractor & Employee Classification effective from March 11th, 2024

· What’s the New Test that Determines Status

· What classifications of workers are permitted under IRS Rules

· What is the common law rule and how is it used to determine worker status

· What are the three factors the IRS uses to determine worker status and how to apply them correctly

· How the FLSA rules differ from the IRS rules and why you must follow both even as the FLSA regs are being update in 2024

· How does the state trump both the IRS and the FLSA on determining independent contractor status with the ABC test for SUI

· What are the latest agreements or programs being used by the IRS, DOL and the states to “find” misclassified employees

· Using the Form SS-8 to your advantage to determine worker status

· Who gets a W-2 and who gets a 1099 and why it should never be the same worker

· Find out how easily a 1099 audit can be triggered and why the chances of getting one are on the rise

· What are the penalties for misclassifying an employee as an independent contractor and who assesses them. It is not just the IRS you have to worry about.

· You found out you have a misclassified employee—now what?

Changes are here for contractor vs. employee classification. A new rule in effect from March 11th, 2024 regarding the classification of individuals as independent contractors. Employers may find it difficult to properly classify workers as independent contractors or employees due to these changes. The Department of Labor (DOL) independent contractor rule involves a new test with a different approach to classify workers, which could present challenges. Businesses should be prepared to adapt to remain compliant.

This webinar examines DOL’s new Rule, what the requirements are to correctly classify a worker as an independent contractor and also the requirements for when a worker must be classified as an employee.

· Payroll Executives/Managers/Administrators/Professionals/Practitioners/Entry Level Personnel

· Human Resources Executives/Managers/Administrators

· Accounting Personnel

· Business Owners/Executive Officers/Operations and Departmental Managers

· Lawmakers

· Attorneys/Legal Professionals

· Any individual or entity that must deal with the complexities and requirements of Payroll compliance issues

Vicki M. Lambert, CPP,

is President and Academic Director of The Payroll Advisor™, a firm specializing

in payroll education and training. The company’s website www.thepayrolladvisor.com offers a payroll news

service which keeps payroll professionals up-to-date on the latest rules and

regulations.

With nearly 40 years of hands-on experience in all facets of payroll

functions as well as over three decades as a trainer and author, Ms. Lambert

has become the most sought-after and respected voice in the practice and

management of payroll issues. She has

conducted open market training seminars on payroll issues across the United

States that have been attended by executives and professionals from some of the

most prestigious firms in business today.

A pioneer in electronic and online education, Ms.

Lambert produces and presents payroll-related audio seminars, webinars, and

webcasts for clients, APA chapters, and business groups throughout the country.

Ms. Lambert is an adjunct faculty member at Brandman University in Southern

California and is the creator of and instructor for their Practical Payroll

Online program, which is approved for recertification hours by the APA. She is

also the instructor for the American Payroll Association’s “PayTrain” online program

also offered by Brandman University.

SHRM -

Pearl Academy is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.5 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

Sign up now on pearlacademy.net. Visit pearlacademy.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Pearl Education to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on Pearl Education today!

Go for the topic of your keen interest on pearlacademy.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Pearl Education offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Pearl Education offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Pearl Education has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Pearl Education brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Pearl Education webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!