Welcome To Biggest Online compliance Platform

Human Resource & Payroll

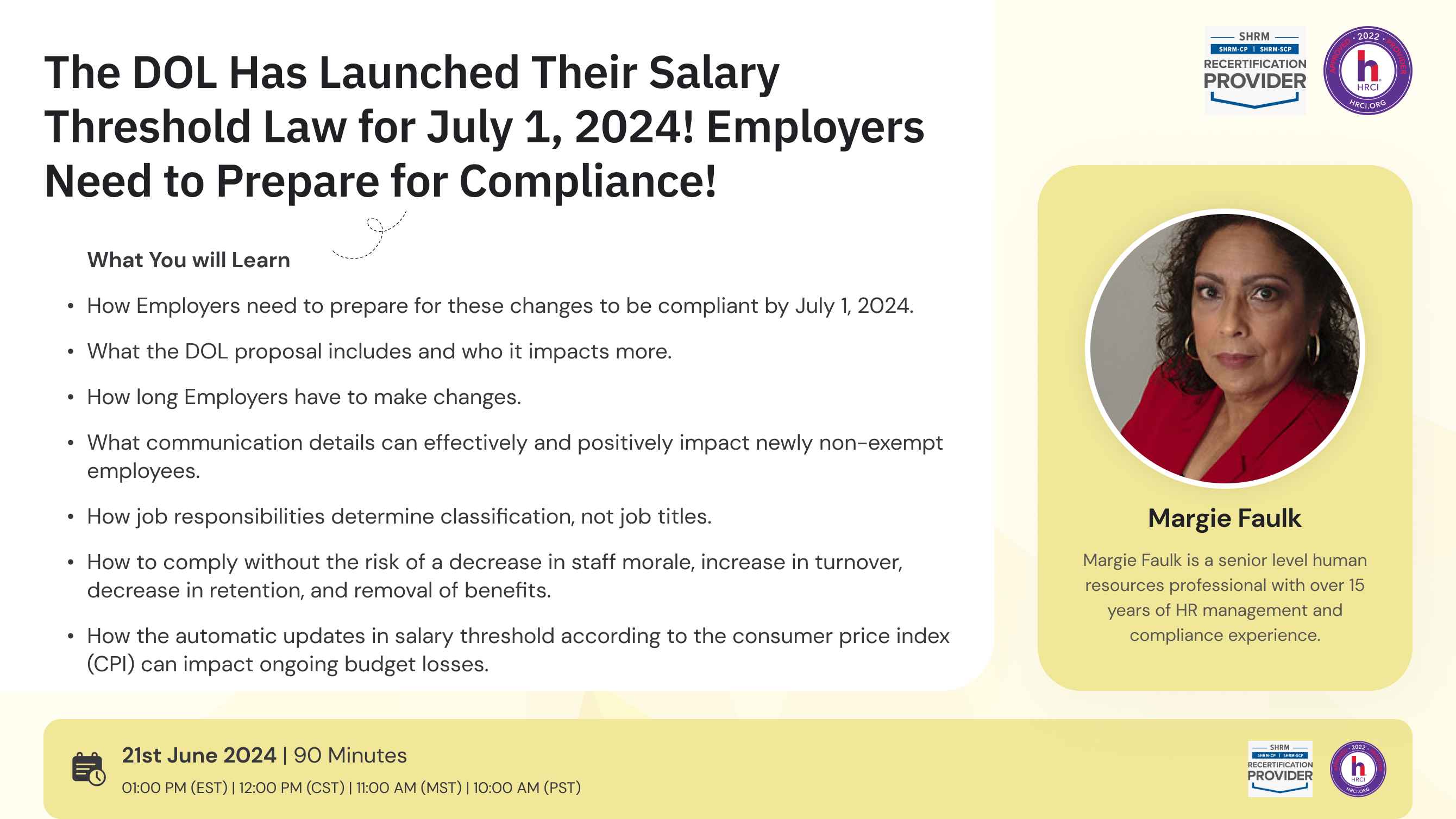

On April 23, 2024, the U.S. Department of Labor (DOL) issued its much-anticipated final rule raising the salary threshold for employees to be exempt from federal overtime requirements under the Fair Labor Standards Act (FLSA). The new rule significantly increases the minimum salary requirement for executive, professional, and administrative employees (aka “white-collar workers”), effective July 1, 2024.

The new rule does not modify the duties test for either the white-collar or highly compensated employee exemption, which also must be satisfied for an employee to properly be classified as exempt from federal overtime pay requirements.

The new salary threshold will occur in two phases. Effective July 1, 2024, the threshold will increase to $844 per week, which is the equivalent of an annual salary of $43,888. Effective January 1, 2025, the threshold will then increase to $1,128 per week, which is the equivalent of an annual salary of $58,656.

- How Employers need to prepare for these changes to be compliant by July 1, 2024

- What the DOL proposal includes and who it impacts more.

- How long Employers have to make changes.

- What communication details can effectively and positively impact newly non-exempt employees.

- How job responsibilities determine classification, not job titles.

- How to comply without the risk of a decrease in staff morale, increase in turnover, decrease in retention, and removal of benefits.

- How the automatic updates in salary threshold according to the consumer price index (CPI) can impact ongoing budget losses.

- How employers should confirm the duties tests before making negative decisions.

- How the Executive Exemption, Administrative Exemption, and Professional Exemptions can confuse the Employer's judgment on exempt and non-exempt employees.

- How Employers can use the Fair Labor Standards Act to prepare for identifying the proper compliance guidelines.

- What resources Employers can use to mitigate the negative response by employees.

- What Employers need to do to determine how state overtime regulations impact federal regulations and which supersedes them.

Employers should learn that the previous overtime increase created severe complications regarding communications to impacted employees, a decrease in staff morale for those who believed that it was a demotion, loss of benefits when they decided to reduce hours, and costs, challenges with job descriptions and expected impact in Employer’s budget. It led to an increase in turnover and a decrease in retention.

Employers can take the time to review and prepare for setting guidelines on how they communicate the impact to employees, make effective decisions on how to cut costs without reducing employee hours or benefits, and develop a training program for managers and newly non-exempt employees.

- All Employers

- Business Owners

- Company Leadership

- Compliance professionals

- Payroll Administrators

- HR Professionals

- Managers

- Supervisors

- Employers in all industries

- Small business owners

Margie Faulk is a senior level human resources professional with over 15 years of HR management and compliance experience. A current Compliance Advisor for HR Compliance Solutions, LLC, Margie, has worked as an HR Compliance advisor for major corporations and small businesses in the small, large, private, public, Non-profit sectors and International compliance. Margie has provided small to large businesses with risk management strategies that protect companies and reduces potential workplace fines and penalties from violation of employment regulations. Margie is bilingual (Spanish) fluent and Bi-cultural. Margie’s area of expertise includes Criminal Background Screening Policies and auditing, I-9 document correction and storage compliance, Immigration compliance, employee handbook development, policy development, sexual harassment investigations/certified training, SOX regulations, payroll compliance, compliance consulting, monitoring US-based federal, state and local regulations, employee relations issues, internal investigations, HR management, compliance consulting, internal/external audits, and performance management. Margie’s unique training philosophy includes providing free customized tools for all attendees. These tools are customized and have been proven to be part an effective risk management strategy. Some of the customized tools include the I-9 Self Audit. Correction and Storage program, Ban the Box Decision Matrix Policy that Employers can provide in a dispute for allegations, Family Medical Leave Act (FMLA) Compliance Guide, Drug-Free Workplace Volatile Termination E-Book and other compliance program tools when attendees register and attend Margie’s trainings. Margie holds professional human resources certification (PHR) from the HR Certification Institution (HRCI) and SHRM-CP certification from the Society for Human Resources Management. Margie is a member of the Society of Corporate Compliance & Ethics (SCCE).

SHRM -

PearlEducation is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.5 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

Sign up now on pearlacademy.net. Visit pearlacademy.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Pearl Education to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on Pearl Education today!

Go for the topic of your keen interest on pearlacademy.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Pearl Education offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Pearl Education offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Pearl Education has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Pearl Education brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Pearl Education webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!