Welcome To Biggest Online compliance Platform

Banking, Finance, Accounting & Taxation

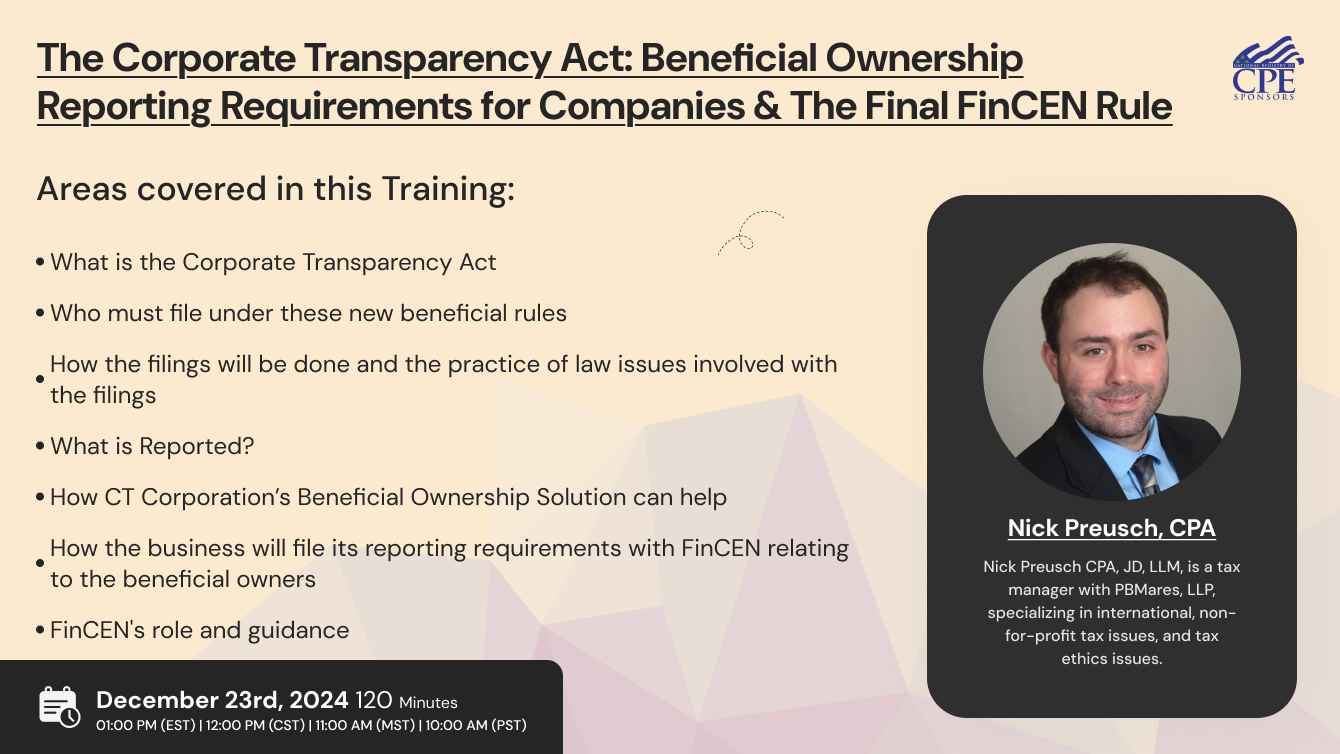

With the formal implementation of the US Corporate Transparency Act (CTA) on 1 January 2024, most businesses will have to disclose information relating to ownership, officers, and controlling persons to the US Treasury Department’s Financial Crimes Enforcement Network (FinCEN).

The Corporate Transparency Act requires many companies doing business in the United States to report information to the U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) about who ultimately owns or controls them. Join this webinar for information on beneficial ownership information reporting requirements and how to comply with the law.

· What is the Corporate Transparency Act

· Who must file under these New Beneficial Rules

· What is Reported? What are Reporting requirements?

· How the filings will be done and the practice of law issues involved with the filings

· Beneficial ownership information

· Compliance Process & Exemptions

· How CT Corporation’s Beneficial Ownership Solution can help

· FinCEN's role and guidance

· Penalties for non-compliance

· To Analyse Regulations for reporting requirements of the business.

· To discuss how the business will file its reporting requirements with FinCEN relating to the beneficial owners.

· To identify who must file a report and what information must be provided.

· CPA

· Enrolled Agents (EAs)

· Tax Professionals

· Attorneys

· Other Tax Preparers

· Finance professionals

· Financial planners

Recommended CPE credit – 2.0

Recommended field of study – Taxes

Session Prerequisites and preparation: None

Session learning level: Basic

Location: Virtual/Online

Delivery method: Group Internet Based

Nick Preusch CPA, JD, LLM, is a tax manager with PBMares, LLP. Nick has participated in helping high wealth individual and large business entities with complex tax compliance, along with specializing in international, non-for-profit tax issues, and tax ethics issues.

Nick has also worked with the Internal Revenue Service as a Revenue Agent and an Attorney with the IRS Office of Professional Responsibility. Nick is a graduate of Carthage College with a BS in Accounting and Business, University of Connecticut with a MA in Accounting, Case Western Reserve University with a JD, and Georgetown University with an LLM in taxation. Nick has also authored publications for the AICPA’s Journal of Accountancy, AICPA’s Tax Advisor, NATP’s Tax Pro Journal, and CCH’s Journal of Tax Practice and Procedure. He also co-authored a textbook, Tax Preparer Penalties and Circular 230 Enforcement, published by Thomson Reuters. He has lectured nationally on topics such as ethics, complex tax transactions and IRS practice and procedure.

Currently Nick is an adjunct professor at the University of Mary Washington. Nick has been recognized as the Top 5 Under 35 CPAs in Virginia by the VSCPA in 2017 and CPA Practice Advisor’s Top 40 Under 40. He is a member of the VSCPA’s Tax Advisory Committee and Ethics Committee, and the AICPA’s Tax Practice and Responsibilities Committee.

Pearl Education is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

Sign up now on pearlacademy.net. Visit pearlacademy.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Pearl Education to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on Pearl Education today!

Go for the topic of your keen interest on pearlacademy.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Pearl Education offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Pearl Education offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Pearl Education has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Pearl Education brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Pearl Education webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!