Welcome To Biggest Online compliance Platform

Human Resource & Payroll

Companies are providing more fringe benefits to employers more than ever before, thus reduces company cost but raises employee morale. Because of the IRS has more to say on what Fringe Benefits are taxable and what are not. The IRS for non-taxable fringe benefits puts a lot of regulation around how the fringe benefit is given and when that also determines if a thought non-taxable item may end up being taxable.

As a payroll professional you must know cold—no guessing—when a fringe benefit is taxable and when it is not, when it is reportable and when it is not. Payroll must know when providing a fringe benefit must be considered wages or if it is “tax free”. What if the employee pays some of the cost of a fringe benefit? How does that affect taxing and reporting? Are there dollar limits? Does it become taxable after a certain amount? And after you have mastered all the facts along comes a new tax bill by Congress that can change everything you just learned when it comes to taxing fringe benefits.

All fringe benefits must be handled correctly, under the latest rules, to minimize the chance for penalties and interest to be levied against your company or for triggering larger and more intrusive governmental audits.

• Review FMV (Fair Market Value) and how the IRS determines it.

• Discussion on No additional cost services, employee discounts, working condition Fringe Benefits & De minimis Fringe Benefits.

• Transportation Fringe Benefits - Review qualified transportation benefits

• How to calculate the taxable wages for the personal use of a company vehicle

• Discuss several excludable fringe benefits such as Retirement planning, athletic facilities, achievement awards etc.

• Discuss Fringe Benefits that should be taxable

• Review Moving/Relocation Expenses

• Working Condition Fringe Benefits

• De Minimis Fringe Benefits

• Review executive taxation items, like spousal travel. Company aircraft usage etc.

• Once a benefit is determined taxable, how to handle it

• Brief overview of how to handle any Fringe Benefits that AP pay.

• Review of at home office amounts for remote workers

• IRS ruling on cell phones

• Educational assistance programs and taxation

After attending this webinar, you will walk away with a better understanding of the IRS view on fringe benefit taxation. The details of the IRC exceptions allowed by the IRS will be detailed and explained to participants. You will be able to better identify and calculate the fair market value of fringe benefits for taxation purposes. You will get in-depth knowledge on-

• IRS rules for taxation of Fringe Benefits

• How to calculate the value of a noncash fringe benefit

• Review of excludable fringe benefits

• Details of how the tax cuts and jobs act impacted fringe benefits

• Procedures for recording fringe benefits

• Year-end best practices for fringe benefit taxation

• Payroll Professionals

• HR professionals

• Accounting Personnel

• Business Owners

• Attorneys/ Legal Professionals

• Operations and Departmental Managers

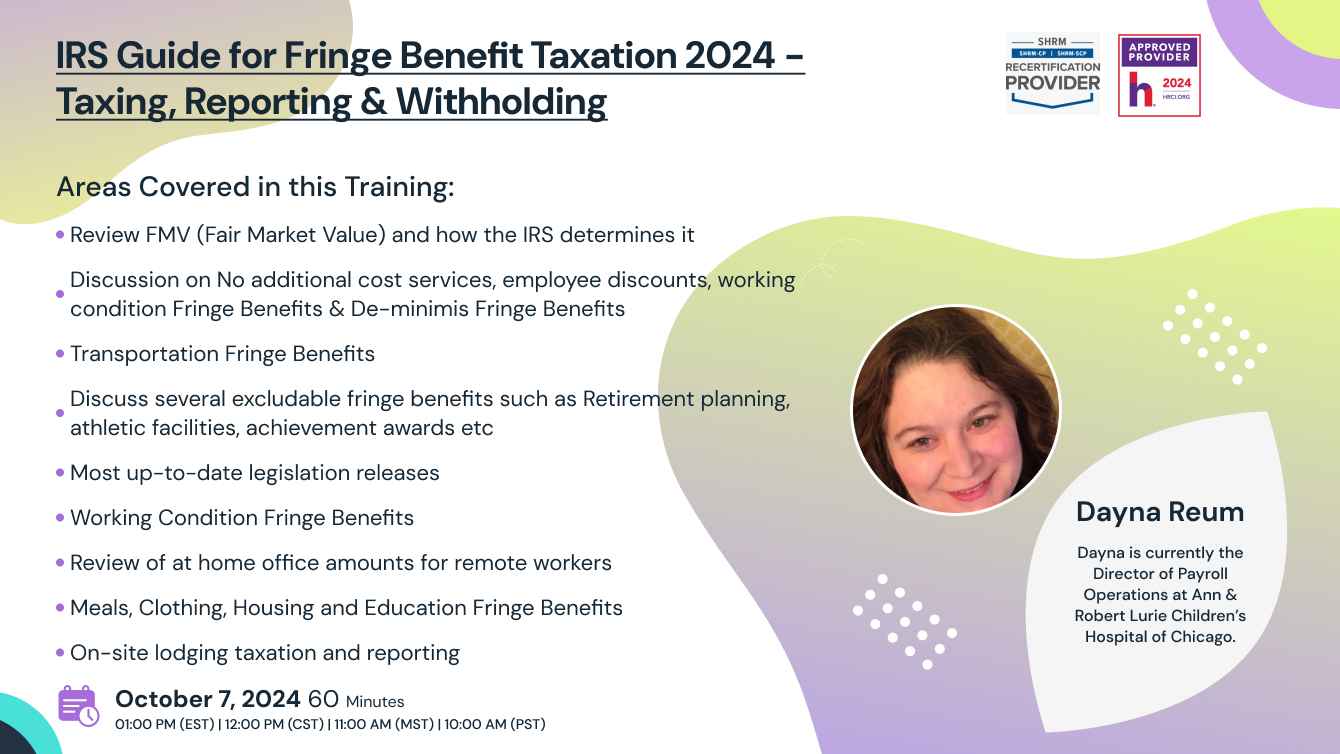

Dayna is currently the Director of Payroll Operations at Ann & Robert Lurie Children’s Hospital of Chicago. Dayna has been heavily involved in the payroll field for over 17 years. Starting as a payroll clerk at a small Tucson company, Dayna moved on to be a Payroll Team Leader at Honeywell Inc. During Dayna’s time at Honeywell she obtained her FPC (Fundamental Payroll Certification) through the American Payroll Association. She also received several merit awards for Customer Service and Acquisitions and Divestitures.

Dayna is no stranger to teaching she has taught at the Metro Phoenix American Payroll Association meetings and at the Arizona State Payroll Conference. Topics including Payroll Basics, Global/Cultural Awareness, Immigration Basics for the Payroll Professional, Multi-State and Local Taxation and Quality Control for Payroll, International and Canadian payroll. Dayna has her CPP (Certified Payroll Professional) through the APA. She also serves on the National American Payroll Association on the National Strategic Leadership Task Force, Government Affairs Task Force (PA Local tax subcommittee). Dayna has received a Citation of Merit for her service along with being a Gold Pin member of the APA. Besides her payroll accomplishments, Dayna is certified in HR hiring and firing practices and is a Six-Sigma Greenbelt.

SHRM -

Pearl Education is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.0 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

NASBA -

Pearl Education is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

Sign up now on pearlacademy.net. Visit pearlacademy.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Pearl Education to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on Pearl Education today!

Go for the topic of your keen interest on pearlacademy.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Pearl Education offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Pearl Education offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Pearl Education has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Pearl Education brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Pearl Education webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!