Welcome To Biggest Online compliance Platform

Banking, Finance, Accounting & Taxation

Employer's Quarterly Federal Tax Return for the third quarter is due by October 31st, 2022. Businesses use Form 941 to report income taxes and payroll taxes that they withhold from their employees’ wages. It is also used to calculate and report Social Security and Medicare taxes. Although you are free to either file it on paper or opt for the federal e-filing system.

The E-file Mandate, though, is changing for 2022. The electronic filing mandate refers to how employers file W-2s and 1099s with the IRS. Since the late 1980s the threshold has been 250 (if a business filed more than 250 forms, it was required to file electronically with the IRS). Proposed regulations call for the threshold to drop to 100 for 2022 forms filed in 2023, and to 10 for 2023 forms filed in 2024. It is critical to meet the mandate, because employers would be subject to a failure to file penalty if they file on paper when they should have filed electronically.

The IRS may impose penalties, if you fail to file Form 941. You will most likely be charged a penalty of 5% of the total tax amount due, but that's not it. Your business will continue to be charged an additional 5% every month the return has not been submitted and that continues for up to five months. Thus, it is crucial to file it on time and the reporting must be done without errors.

The IRS also released a new version of Form W-4 that dramatically has changed the way employees now fill out the form. This affects how employers calculate withholding. The W-4 topic is actually "more than it seems" as far as when employees need to fill out a new W-4, when the employer needs to ask for a new W-4, and penalties for failure to comply.

Join us on Pearleducation this September to understand the new Form W-4 and to cover other payroll updates, including the latest revisions to the Form 941. This training will do a deep dive into the Tax Code and Regulations relating to the W-4 and the filing in 2022. You will learn to claim the Employee Retention Credit if you haven't already.

Additionally, we will discuss what's new with Form 1099-NEC and contract labor reporting and what's there to follow up with in 2022. We will explain the reporting of independent contractors in detail. Register today!

-Overview of the new W-4

-Form 941 - Quarter 3 filing in 2022 and the latest changes

-Employee retention credits (ERC)

-The regulations relating to Form W-4 - more potholes than you'd think

-1099-NEC updates - NEW layout for 2022

-Reporting of independent contractors

-The E-file Mandate is changing for 2022

-Other updates as time allows

-How to prepare your staff to comply?

-What do employers do with the W-4?

-How to handle moving expenses?

-How to calculate withholding now and with the new W-4?

-Understand changes to Form 1099-MISC and Form 1099-NEC

-Understand what to do with current employees who already have a W-4 on file

-Understand the new Form W-4 and the proper way to process a federal W-4

-Understand other payroll changes, such as the treatment of moving expenses

Before changes, the Form W-4 was a critical form that all companies have to obtain from employees and has had special processing requirements. The latest Form W-4, Employee’s Withholding Certificate, radically changes the way employee paychecks are calculated. The form now includes major revisions, including several new input elements for federal income tax withholding calculations, which will require significant reprogramming of payroll systems.

This training will prepare the payroll professionals to understand the changes to the Form W-4 for the filing in 2022 and to review the recently released draft of the W-4 Form. We will also discuss the IRS specific laws around the processing of Form W-4 and how you should handle them.

-Tax professionals

-Payroll compliance practitioners

-Accounts directors

-Bookkeepers

-Tax managers

-Accounting managers

-Tax attorneys

-Tax directors

-Accounting firms

-Tax firms

-Tax practitioners

-Accountants

-CPAs

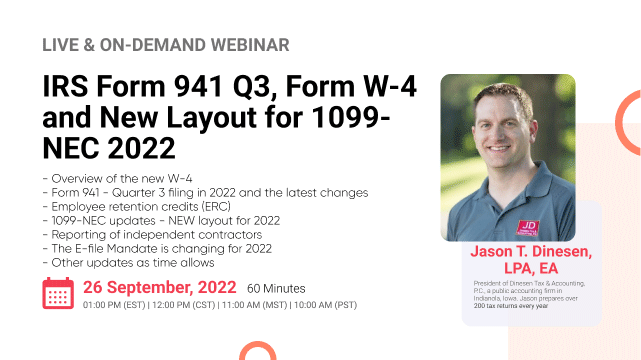

Jason Dinesen is the President of Dinesen Tax & Accounting, P.C., a public accounting firm in Indianola, Iowa. Jason prepares over 200 tax returns every year and deals with a variety of situations ranging from individual taxes to business taxes. He has been presenting since 2012.

Pealeducation Webinar Certification - Pearleducation rewards you with Pearleducation Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Pearleducation Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Pearleducation doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on pearlacademy.net. Visit pearlacademy.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Pearl Education to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on Pearl Education today!

Go for the topic of your keen interest on pearlacademy.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Pearl Education offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Pearl Education offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Pearl Education has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Pearl Education brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Pearl Education webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!