Welcome To Biggest Online compliance Platform

Banking, Finance, Accounting & Taxation

This webinar will be an overview of the changes made to the IRC by the Inflation Act of 2022. A look at the tax reform that will affect Corporations, and high-income earners making $400,000. The clean vehicle credit expansion and new used clean vehicle credit will also be looked at during this time. The expansion and new qualifications for individual and commercial clean vehicle credits will be discussed in the first half of this presentation. The second half of the presentation will be focused on other sources of clean energy that are eligible for tax credits under the Inflation Reduction Act. This includes the credit for solar, wind, and fuel cell energy-powered homes.

-Tax Reform - Understand how tax rates will change for corporations, and individuals making over $400,000.

-Understand how to the clean vehicle credit has been expanded and the new qualifications.

-Learn about the new used clean vehicle tax credit for eligible used clean vehicles.

-Learn about §45W which allows businesses to claim a clean vehicle credit of up to $40,000 per qualifying vehicle

-Understand the changes to §25D for solar energy credits, fuel cells, and other clean energy for homes and commercial spaces.

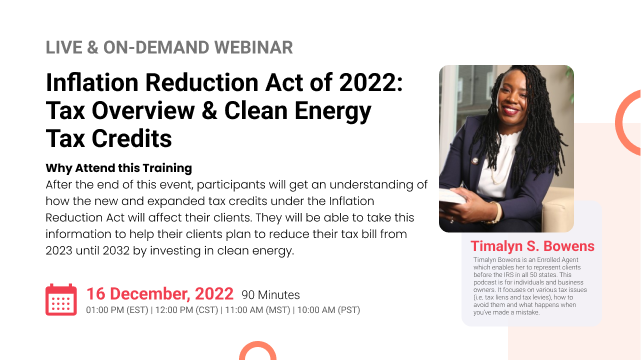

After the end of this event, participants will get an understanding of how the new and expanded tax credits under the Inflation Reduction Act will affect their clients. They will be able to take this information to help their clients plan to reduce their tax bill from 2023 until 2032 by investing in clean energy.

Participants will also know how their high-earning clients will be affected by the tax reform and seek out planning opportunities for them. As well as any Corporate clients they may have.

Help your clients reduce their tax bill by $7,500 by purchasing a qualifying clean vehicle. Help your business clients save up to $40,000 per qualifying clean commercial vehicle.

-Tax professionals and financial advisors with clients interested in investing in clean energy for their vehicles, homes, or businesses should also attend this webinar. They will love knowing if their clients qualify and what they should look for to make sure their clients can take full advantage of the tax credits.

-Professionals with high-income earning clients and or corporate clients should also attend so they will know how their tax clients will be affected by the tax reform under the Inflation Reduction Act.

Timalyn S. Bowens, EA, is an IRS-licensed enrolled agent who has been working in the tax industry for 11 years. She started Bowens Tax & Bookkeeping Solutions in 2016, helping small businesses keep their records straight and compliant with the IRS.

After becoming an enrolled agent in 2018, she began to fully help her clients negotiate with the IRS and represent them in audits. In 2021, her company became Bowens Tax Solutions as their primary focus is now to represent taxpayers before the IRS.

Timalyn is a member of the National Association of Enrolled Agents (NAEA) and the American Society of Tax Problem Solvers (ASTPS). She will be a speaker at an NAEA event later this year to train other tax professionals on a representation topic. She was also a speaker at the Tax and Accounting Summit of 2021.

In addition, Timalyn is a member of the Bellarmine University Alumni Board of Directors, where she serves on the mentor committee. She is also a Bellarmine University Alumni Ambassador, helping prospective students learn more about the university.

Pealeducation Webinar Certification - Pearleducation rewards you with Pearleducation Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Pearleducation Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Pearleducation doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on pearlacademy.net. Visit pearlacademy.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Pearl Education to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on Pearl Education today!

Go for the topic of your keen interest on pearlacademy.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Pearl Education offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Pearl Education offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Pearl Education has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Pearl Education brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Pearl Education webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!