Welcome To Biggest Online compliance Platform

Human Resource & Payroll

The IRS is auditing employers more and more each day and an area of most non-compliance. Most non-compliance occurs in regard to handling Fringe Benefits. Plus employers are offering more Fringe benefits versus cash compensation because it is a cost savings to employers. Complying with the Internal Revenue Tax Code requirements and federal regulations for fringe benefits such as relocation, meals, lodging, educational assistance, health insurance, transportation, and third-party sick pay can be complicated.

Companies are providing more fringe benefits to employers more than ever before, thus reduces company cost but raises employee morale. Because of this, the IRS has more to say on what Fringe Benefits are taxable and what are not. The IRS for non-taxable fringe benefits puts a lot of regulation around how the fringe benefit is given and when that also determines if a thought non- taxable item may end up being taxable.

All fringe benefits must be handled correctly, under the latest rules, to minimize the chance for penalties and interest to be levied against your company or for triggering larger and more intrusive governmental audits

-Review FMV (Fair Market Value) and how the IRS determines it.

-Discussion on No additional cost services, employee discounts, working condition fringe benefits & De-Minimis Fringe Benefits.

-Review qualified transportation benefits

-Discuss a number of excludable fringe benefits such as Retirement planning, athletic facilities, achievement awards, etc.

-Discuss Fringe benefits that should be taxable

-Review Moving/Relocation Expenses

-Review executive taxation items, like spousal travel. Company aircraft usage etc.

-Once a benefit is determined taxable, how to handle it

-Brief overview of how to handle any fringe benefits that AP pay.

The taxation and reporting for these fringe benefits offered by many companies today are major components of a payroll department’s responsibilities. And with the IRS looking for consistency of treatment—you can’t afford to make a mistake

As a payroll professional you must know cold—no guessing—when a fringe benefit is taxable and when it is not when it is reportable and when it is not. Payroll must know when providing a fringe benefit must be considered wages or if it is “tax-free”. What if the employee pays some of the cost of a fringe benefit? How does that affect taxing and reporting? Are there dollar limits? Does it become taxable after a certain amount? And after you have mastered all the facts along comes a new tax bill by Congress that can change everything you just learned when it comes to taxing fringe benefits.

By attending this webinar, participants with walk away with a better understanding of the IRS view on fringe benefits taxation. The details of the IRC exceptions allowed by the IRS will be detailed and explained to participants. Also, participants will be able to better identify and calculate the fair market value of fringe benefits for taxation purposes.

-Payroll Supervisors and Personnel

-HR Supervisors and Personnel

-Public Accountants

-Internal Auditors

-Tax Compliance Officers

-Employee Benefits Administrators

-Officers and Managers with Tax or Benefits Compliance Oversight

-Company / Business Owners

-Managers/ Supervisors

-Public Agency Managers

-Audit and Compliance Personnel / Risk Managers

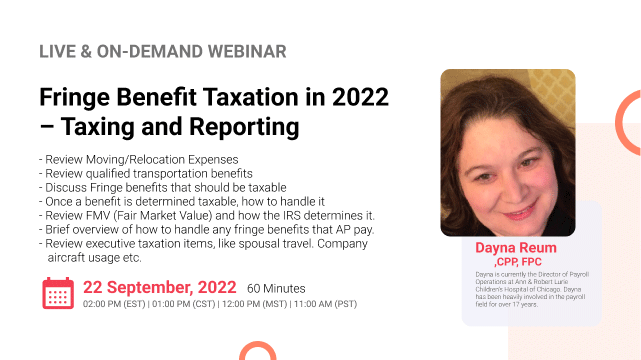

Dayna is currently the Director of Payroll Operations at Ann & Robert Lurie Children’s Hospital of Chicago. Dayna has been heavily involved in the payroll field for over 17 years. Starting as a payroll clerk at a small Tucson company, Dayna moved on to be a Payroll Team Leader at Honeywell Inc. During Dayna’s time at Honeywell she obtained her FPC (Fundamental Payroll Certification) through the American Payroll Association. She also received several merit awards for Customer Service and Acquisitions and Divestitures.

Dayna is no stranger to teaching she has taught at the Metro Phoenix American Payroll Association meetings and at the Arizona State Payroll Conference. Topics including Payroll Basics, Global/Cultural Awareness, Immigration Basics for the Payroll Professional, Multi-State and Local Taxation and Quality Control for Payroll, International and Canadian payroll. Dayna has her CPP (Certified Payroll Professional) through the APA. She also serves on the National American Payroll Association on the National Strategic Leadership Task Force, Government Affairs Task Force (PA Local tax subcommittee). Dayna has received a Citation of Merit for her service along with being a Gold Pin member of the APA. Besides her payroll accomplishments, Dayna is certified in HR hiring and firing practices and is a Six-Sigma Greenbelt.

Cpaacademy Webinar Certification - Cpaacademy rewards you with Cpaacademy Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Cpaacademy Courses and Webinar or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Cpaacademy doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on pearlacademy.net. Visit pearlacademy.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Pearl Education to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on Pearl Education today!

Go for the topic of your keen interest on pearlacademy.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Pearl Education offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Pearl Education offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Pearl Education has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Pearl Education brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Pearl Education webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!