Welcome To Biggest Online compliance Platform

Human Resource & Payroll

The most important thing to your employees is their paychecks. If those aren’t right, you’ll have a very unhappy staff. And you can have the government come down on you!

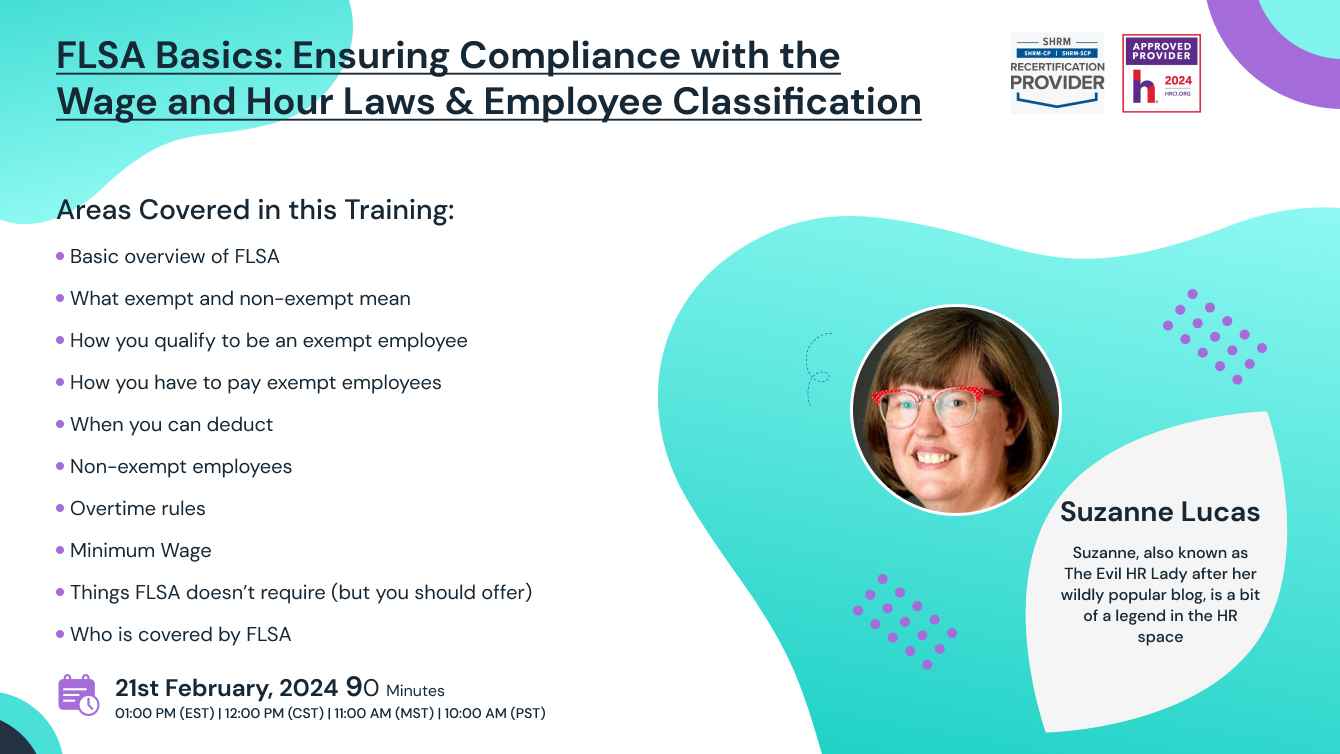

The Fair Labor Standards Act (FLSA) explains how you need to pay your employees. It’s been the law since 1938, so you’d think it would be easy to understand, but times have changed, and the law hasn’t caught up.

This webinar will give you a basic understanding of how to keep your employees paid properly and legally!

In this webinar, you’ll learn-

· Basic overview of FLSA

· What exempt and non-exempt mean

· How you qualify to be an exempt employee

o What makes you a manager

o What makes you a professional

o What makes you an administrative professional

o What makes you outside sales

· How you have to pay exempt employees

· When you can deduct

· Non-exempt employees

o Overtime rules

o Piece rate

o Tipped staff

· Minimum Wage

· Things FLSA doesn’t require (but you should offer)

· Who is covered by FLSA

If you want to keep the Department of Labor from knocking at your door, you should understand the basics of FLSA. Knowing the legal requirements for paying your employees can save you headaches and literally millions of dollars in back-pay lawsuits.

· Business Owners

· Human Resources professionals

· Managers & Supervisors

· Project Managers

· Team Leaders

Suzanne Lucas spent 10 years in

corporate HR where she hired, fired, managed the numbers, and double- checked

with the lawyers. She left the corporate world to advise people and companies

on how to have the best Human Resources departments possible.

Suzanne integrates best practices

with innovative ideas and humour, including using improve comedy as a tool for

leadership development.

Suzanne’s writings have been

published at CBS News, Inc. Magazine, Reader’s Digest, and many other sites.

She’s been named a top influencer in HR. You can read her archives at EvilHRLady.org or check out her Tedx Talk: Forget Talent and Get to

Work.

SHRM -

Pearl Education is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.5 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

Sign up now on pearlacademy.net. Visit pearlacademy.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Pearl Education to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on Pearl Education today!

Go for the topic of your keen interest on pearlacademy.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Pearl Education offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Pearl Education offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Pearl Education has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Pearl Education brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Pearl Education webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!