Welcome To Biggest Online compliance Platform

Banking, Finance, Accounting & Taxation

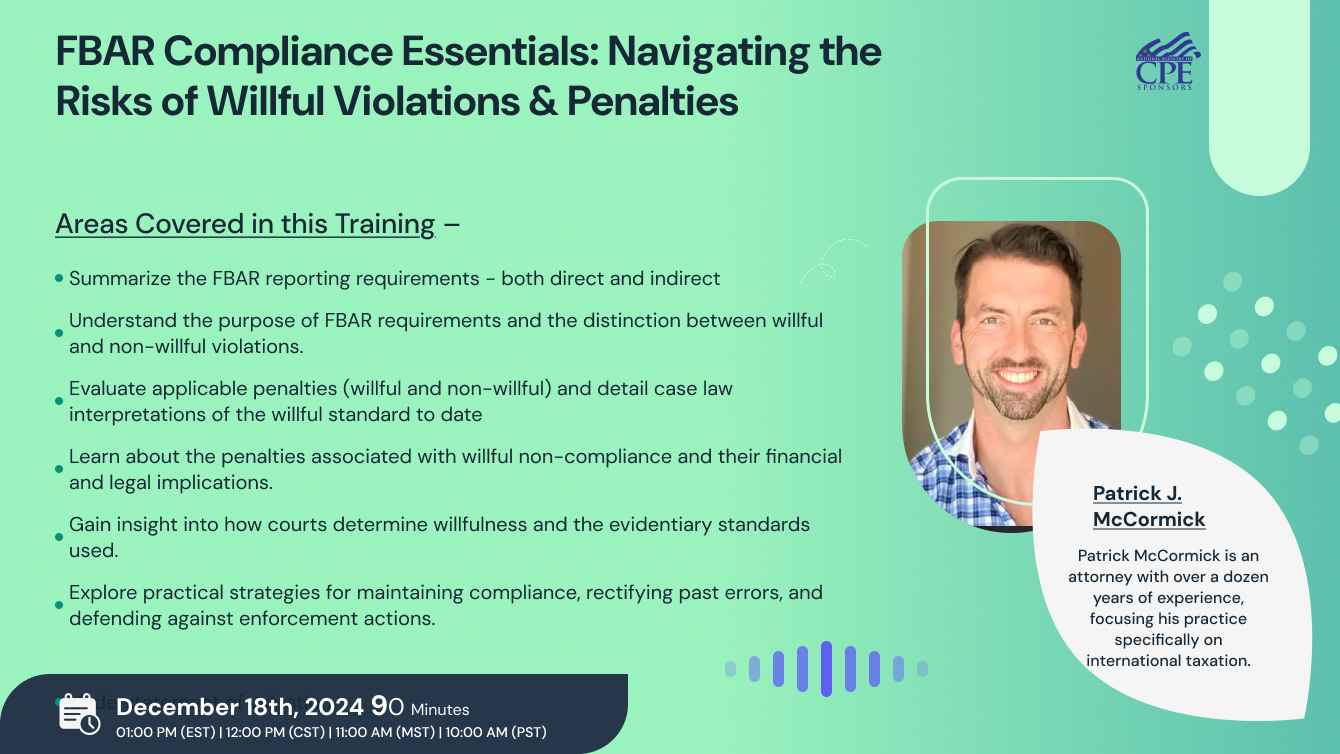

In the foreign information reporting context, arguably no form creates as much consternation in the context of penalty exposure as the Foreign Bank Account Report (better known as the FBAR). Statutorily, willful failures to file FBARs create massive penalty exposure: the greater of $100,000 or 50% of the balance of unreported accounts for the year in question (with a six-year civil statute of limitations). In the FBAR penalty context, the primary focus is typically given to the interpretation of the "willful" standard - and how it connects to maximum penalty exposure.

This webinar will delve into the critical topic of FBAR (Report of Foreign Bank and Financial Accounts) compliance, focusing on the implications of willful non-compliance. Participants will gain an understanding of the legal framework surrounding FBAR requirements, the concept of willfulness, and how intent impacts penalties and enforcement actions. Real-world examples and case studies will illustrate the consequences of willful violations and strategies to mitigate risk and defend against allegations.

· Summarize the FBAR reporting requirements - both direct and indirect

· Understand the purpose of FBAR requirements and the distinction between willful and non-willful violations.

· Evaluate applicable penalties (willful and non-willful) and detail case law interpretations of the willful standard to date

· Identify Internal Revenue Manual limitations to both willful and non-willful penalty assessment, as well as proactive disclosure options where prior reporting failures have occurred

· Learn about the penalties associated with willful non-compliance and their financial and legal implications.

· Gain insight into how courts determine willfulness and the evidentiary standards used.

· Explore practical strategies for maintaining compliance, rectifying past errors, and defending against enforcement actions.

If you or your clients have foreign financial accounts, staying compliant with FBAR regulations is crucial to avoid severe penalties. This webinar provides actionable knowledge to safeguard yourself or your clients against allegations of willful non-compliance. Tax professionals, CPAs, attorneys, and individuals with foreign accounts will benefit from expert guidance on navigating the complexities of FBAR. With increased IRS scrutiny on offshore assets, understanding the nuances of willfulness is more critical than ever for risk mitigation and legal defense.

· CPA - small firm

· CPA - medium firm

· CPA - large firm

· Enrolled Agent

· Tax professionals

· Attorneys

· Tax Attorneys

· Individuals with Foreign Accounts

Patrick McCormick is an attorney with over a dozen years of experience, focusing his practice specifically on international taxation. Mr. McCormick represents both business and individual clients on all aspects of United States international tax rules, both from an income tax and estate/gift tax perspective. He collaborates with Clatid Compliance to help the tax practitioners and professionals stay current and compliant.

Having previously served as a partner at a large law firm, a midsized accounting firm, and a boutique tax law firm, Patrick’s client exposures have covered every conceivable area of American-side international tax matters. Patrick has also represented every type of taxpayer – from multibillion-dollar business enterprises and ultra-high net worth individuals to startups and individuals with complex questions but limited budgets. Mr. McCormick has worked with clients located in over 90 countries on American tax considerations of multinational activities, cultivating specialized knowledge in every area of United States international tax rules.

Patrick's explicit practice focus has facilitated an unparalleled expertise in the field; he is trusted by clients and advisors around the world to obtain optimal results on international tax matters.

NASBA -

Pearl Education is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

Sign up now on pearlacademy.net. Visit pearlacademy.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Pearl Education to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on Pearl Education today!

Go for the topic of your keen interest on pearlacademy.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Pearl Education offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Pearl Education offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Pearl Education has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Pearl Education brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Pearl Education webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!