Welcome To Biggest Online compliance Platform

Banking, Finance, Accounting & Taxation

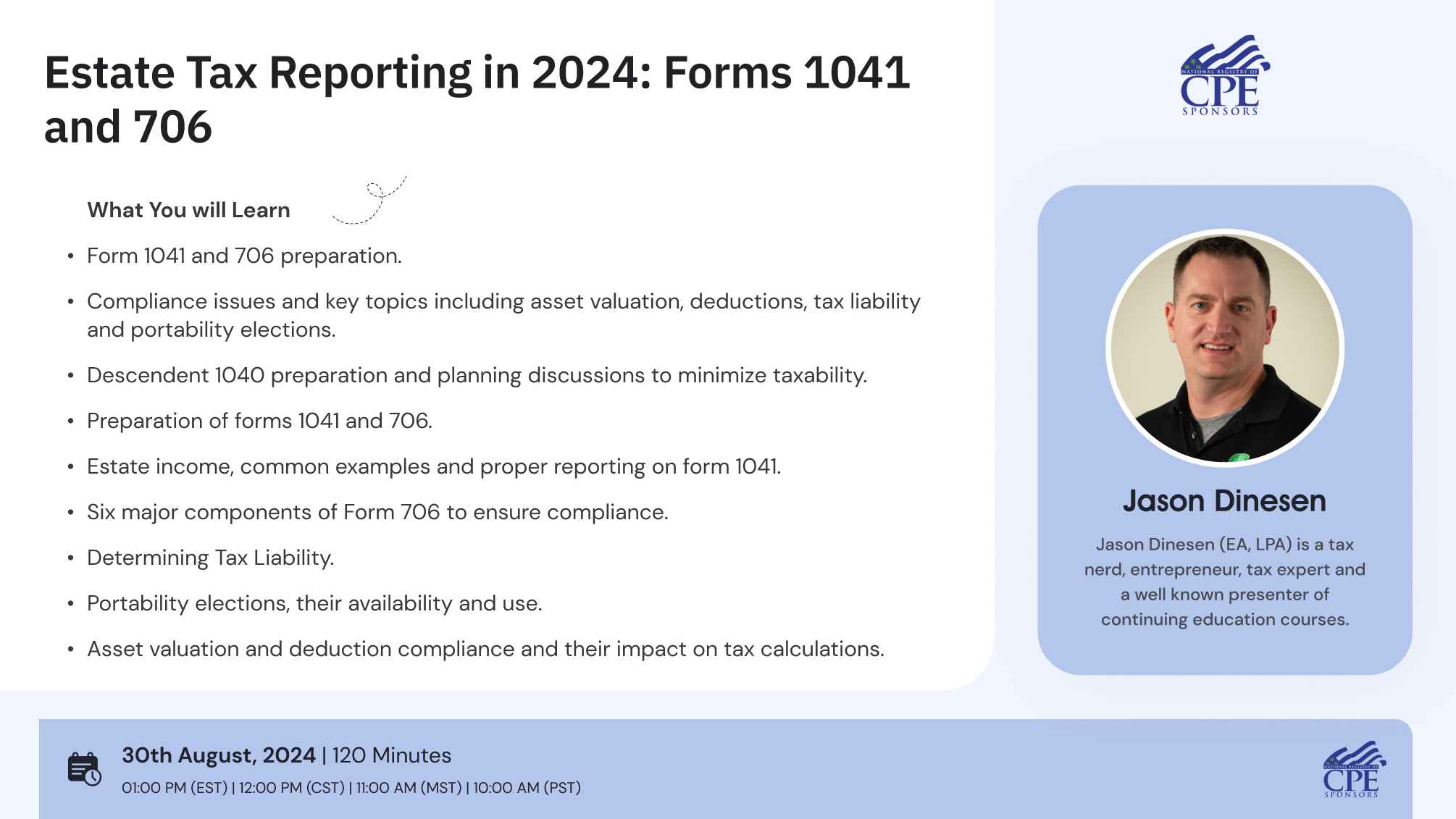

Preparing returns for estates can be difficult, especially if you do not prepare these kinds of returns often, but these services are vital for our clients. This course provides the practitioner with a practical understanding of Federal estate law. We will examine Forms 1041 and 706 and will address how and when to prepare each form. We will also discuss planning suggestions to minimize taxation where possible for clients.

- Form 1041 and 706 preparation.

- Compliance issues and key topics including asset valuation, deductions, tax liability and portability elections.

- Descendent 1040 preparation and planning discussions to minimize taxability.

- Preparation of forms 1041 and 706.

- Estate income, common examples and proper reporting on form 1041.

- Six major components of Form 706 to ensure compliance.

- Determining Tax Liability.

- Portability elections, their availability and use.

- Asset valuation and deduction compliance and their impact on tax calculations.

- The ins and outs of the “portability” rules, including how the rules actually work using common examples.

- Issues involved in the preparation of the decedent’s final federal income tax return (Form 1040).

- Income tax consequences.

- Successfully and correctly complete forms 1041 and 706.

- Understand and obey compliance requirements for forms 1041 and 706.

- Understand asset valuation, estate deductions, and correctly ascertain the impact on tax liability.

- Explain tactics to assist clients in estate planning to minimize future tax liability.

The executor of a decedent's estate uses Form 1041 to report estate income. One uses Form 706 to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code, and, also used to compute the generation-skipping transfer (GST) tax imposed by Chapter 13 on direct skips. This form is a complicated to prepare.

- Accountants

- Tax Preparers

- Lawyers

- Certified Public Accountants

- Enrolled Agents

Jason Dinesen is the President of Dinesen Tax & Accounting, P.C., a public accounting firm in Indianola, Iowa. Jason prepares over 200 tax returns every year and deals with a variety of situations ranging from individual taxes to business taxes. He has been presenting since 2012.

NASBA -

PearlEducation is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

Sign up now on pearlacademy.net. Visit pearlacademy.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Pearl Education to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on Pearl Education today!

Go for the topic of your keen interest on pearlacademy.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Pearl Education offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Pearl Education offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Pearl Education has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Pearl Education brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Pearl Education webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!