Welcome To Biggest Online compliance Platform

Human Resource & Payroll

The overtime threshold is a salary level used to determine which employees are eligible to receive overtime pay when they work over 40 hours in a single workweek. The federal rules governing overtime pay were established by the Fair Labor Standards Act (FLSA), which also described which workers are exempt from these rules and which are not.

For non-exempt employees under FLSA, the overtime rate is at least one-and-a-half times the regular rate of pay for any hours worked above 40 in a given workweek. FLSA defines a workweek as a consecutive seven-day period of time. Employers can choose to pay a higher overtime rate if they wish, but they must meet the minimum federal standard.

Exempt employees, on the other hand, do not qualify to receive overtime pay. The overtime threshold and certain job duties—not job titles—classify individuals for exempt status. These roles are typically based on a yearly salary whereas nonexempt workers are usually hourly.

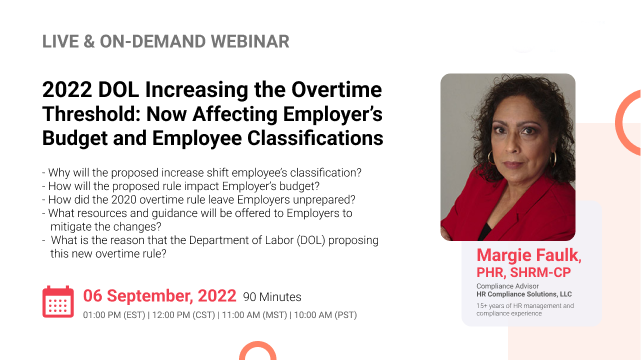

Join us on Pearleducation this September to gain latest insights on the overtime threshold. You will also receive a FREE customized compliance tool to help you develop a better understanding of it. Register now!

-What is the reason that the Department of Labor (DOL) proposing this new overtime rule?

-Why will the proposed increase shift employee’s classification?

-How will the proposed rule impact Employer’s budget?

-How did the 2020 overtime rule leave Employers unprepared?

-What resources and guidance will be offered to Employers to mitigate the changes?

-How does the Duties Test identify the classification of exempt and non-exempt employees?

-How do Employers need to determine proper classification of employees or risk fines and penalties?

-Why does the Fair Labor Standards Act provide Employers with the necessary resources to manage this process?

There are several components to the proposed rule which includes a proposal which was scheduled for April 2022, public comments period and the publishing of the rule with expected dates for implementation.

-Learn how training manager, supervisors and other professionals on the proposed changes will help your risk management strategy

-Learn how to prepare for the proposed rule and be confident with compliance efforts

The Previous overtime rule, impacted Employers and employees in a way that affective morale, changed exempt employees to non-exempt employees, impacted salary calculations, changed employee classification and made the change an administrative nightmare.

Job descriptions were challenged, employee positions based on responsibilities impact the change not titles.

It’s important to correctly classify employees under the FLSA guidelines. Whether an employee will be hourly or salaried is not left entirely to an employer’s discretion, and the distinction is not as simple as “blue-collar” or “white-collar.”

Misclassification is one of the most common compliance mistakes. It can be costly on its own, but it also has implications that can lead to further noncompliance issues regarding attendance, timesheets, payroll, and benefits.

Now may be a good time for employers to consider whether the new rules provide a good opportunity to audit “close call” jobs in their exempt workforce to ensure they remain properly classified (and, if need be, to sync any necessary changes with the implementation of a new rule).

-All Employers

-Business Owners

-Company Leadership

-Compliance professionals

-Payroll Administrators

-HR Professionals

-Managers/Supervisors

-Employers in all industries

-Small Business Owners

Margie Faulk is a senior level human resources professional with over 15 years of HR management and compliance experience. A current Compliance Advisor for HR Compliance Solutions, LLC, Margie, has worked as an HR Compliance advisor for major corporations and small businesses in the small, large, private, public, Non-profit sectors and International compliance. Margie has provided small to large businesses with risk management strategies that protect companies and reduces potential workplace fines and penalties from violation of employment regulations. Margie is bilingual (Spanish) fluent and Bi-cultural. Margie’s area of expertise includes Criminal Background Screening Policies and auditing, I-9 document correction and storage compliance, Immigration compliance, employee handbook development, policy development, sexual harassment investigations/certified training, SOX regulations, payroll compliance, compliance consulting, monitoring US-based federal, state and local regulations, employee relations issues, internal investigations, HR management, compliance consulting, internal/external audits, and performance management. Margie’s unique training philosophy includes providing free customized tools for all attendees. These tools are customized and have been proven to be part an effective risk management strategy. Some of the customized tools include the I-9 Self Audit. Correction and Storage program, Ban the Box Decision Matrix Policy that Employers can provide in a dispute for allegations, Family Medical Leave Act (FMLA) Compliance Guide, Drug-Free Workplace Volatile Termination E-Book and other compliance program tools when attendees register and attend Margie’s trainings. Margie holds professional human resources certification (PHR) from the HR Certification Institution (HRCI) and SHRM-CP certification from the Society for Human Resources Management. Margie is a member of the Society of Corporate Compliance & Ethics (SCCE).

Pealeducation Webinar Certification - Pearleducation rewards you with Pearleducation Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Pearleducation Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Pearleducation doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on pearlacademy.net. Visit pearlacademy.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Pearl Education to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on Pearl Education today!

Go for the topic of your keen interest on pearlacademy.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Pearl Education offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Pearl Education offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Pearl Education has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Pearl Education brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Pearl Education webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!