Welcome To Biggest Online compliance Platform

Human Resource & Payroll

All payroll professionals must know the taxation and reporting requirements for all states where the company has employees working or in the case of reciprocal agreements, living. But for the payroll department that must handle employees who work in multiple states simultaneously or who travel to different states at different times for the employer the taxing and reporting requirements can become an arduous task at best and at worse a total fiasco.

Employees working from home can add even more to the complexity! Questions must be answered, sometimes on an employee by employee or even tougher on a case-by-case basis for an individual employee. Which state income tax is withheld? Does it matter if the employee is a resident or a non-resident of the state? Are there any reciprocal agreements in effect that must be taken into consideration? Which state do we pay the SUI to and what happens if one of the states has disability insurance but the other doesn’t? Or worse yet what if both states require disability insurance to be deducted?

· How to determine state withholding liability

· Who is a resident

· How reciprocal agreements affect taxation of wages

· Resident and non-resident taxation policies

· The four-factor test for state unemployment insurance

· Income and unemployment taxation of Fringe benefits

· What wage and hour laws must be followed

· How to handle income and unemployment insurance taxation for employees working in multiple states

· How working in multiple states could affect withholding for garnishments

· Withholding requirements when an employee is in a state temporarily

· Which states require the use of their own Withholding Allowance Certificate, which states allow either theirs or the Form W-4, and which states do not have a Form

· Reporting wages for multistate employees on Form W-2

· How COVID-19 affects teleworkers who are in a different state

Understanding how to calculate tax for employees in 2 or more states can be confusing. Plus, what state laws for payroll need to be followed when employing employees in more than one state.

To better understand the laws in each state and the tax guidance on how to determine taxation when employees live in one state and work in another. Or for employees that work in multiple states for travel for work. Also, other state laws that affect payroll will be discussed.

This webinar will be tailored to employers that have a large amount of employees that may telecommute across state borders and how employers can manage the tax liability for those employees. Especially when these employees perform work in multiple states. There will also be a discussion on market shifts and the impact the multi-state taxation due to COVID-19 till date.

· Payroll Executives/Managers/Administrators/Professionals/Practitioners/Entry Level Personnel

· Human Resources Executives/Managers/Administrators

· Accounting Personnel

· Business Owners/Executive Officers/Operations and Departmental Managers

· Lawmakers

· Attorneys/Legal Professionals

· Any individual or entity that must deal with the complexities and requirements of paying employees in multiple states

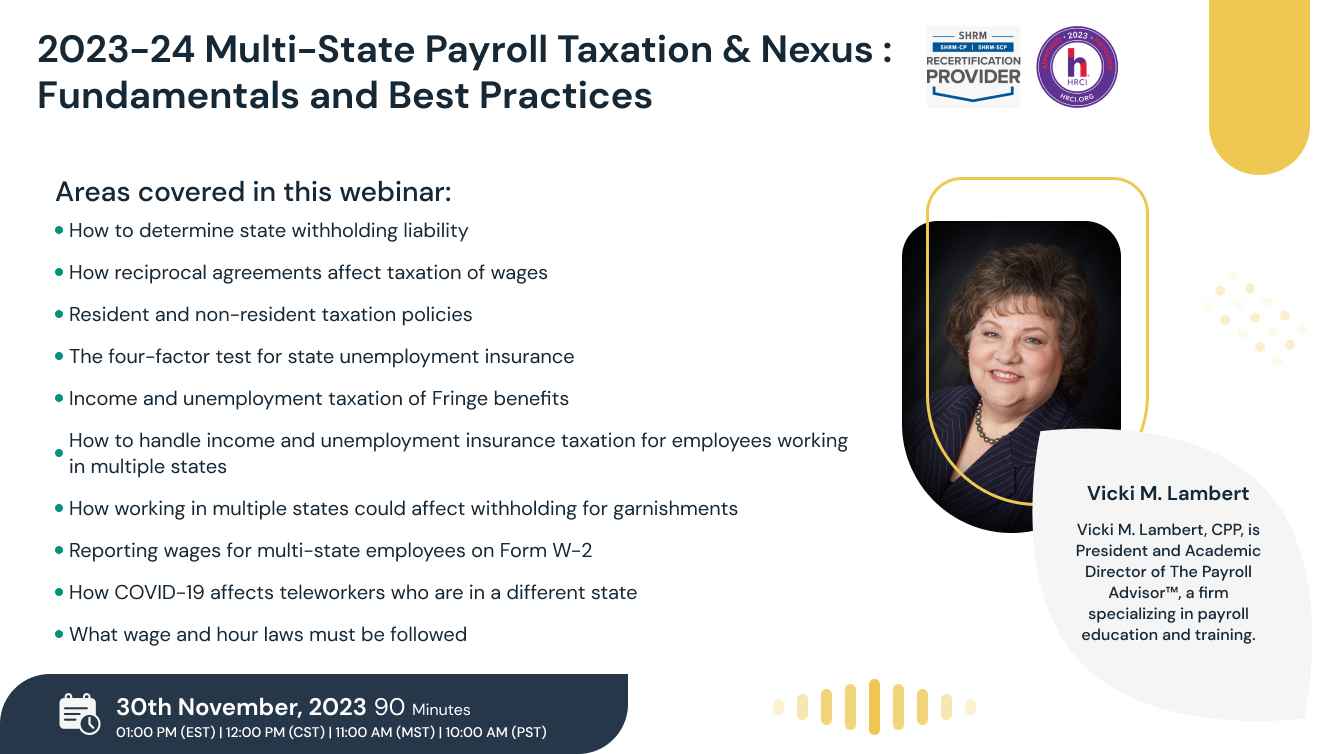

Vicki M. Lambert, CPP,

is President and Academic Director of The Payroll Advisor™, a firm specializing

in payroll education and training. The company’s website www.thepayrolladvisor.com offers a payroll news

service which keeps payroll professionals up-to-date on the latest rules and

regulations.

With nearly 40 years of hands-on experience in all facets of payroll

functions as well as over three decades as a trainer and author, Ms. Lambert

has become the most sought-after and respected voice in the practice and

management of payroll issues. She has

conducted open market training seminars on payroll issues across the United

States that have been attended by executives and professionals from some of the

most prestigious firms in business today.

A pioneer in electronic and online education, Ms.

Lambert produces and presents payroll-related audio seminars, webinars, and

webcasts for clients, APA chapters, and business groups throughout the country.

Ms. Lambert is an adjunct faculty member at Brandman University in Southern

California and is the creator of and instructor for their Practical Payroll

Online program, which is approved for recertification hours by the APA. She is

also the instructor for the American Payroll Association’s “PayTrain” online program

also offered by Brandman University.

SHRM -

Pearl Education is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.5 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

Sign up now on pearlacademy.net. Visit pearlacademy.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Pearl Education to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on Pearl Education today!

Go for the topic of your keen interest on pearlacademy.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Pearl Education offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Pearl Education offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Pearl Education has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Pearl Education brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Pearl Education webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!